Altagas, Prairiesky Royalty, TMX Group

Securities analysts revised their ratings and price targets on several Canadian companies, including Altagas, Prairiesky Royalty and TMX Group, on Friday.

HIGHLIGHTS

* Altagas Ltd

ALA: JP Morgan raises target price to C$36 from C$33

* Franco-Nevada Corp

FNV: BMO raises target price to C$212 from C$210

* Prairiesky Royalty Ltd

PSK: ATB Capital Markets raises target to C$30 from C$28.5

* TMX Group Ltd

X: CIBC raises target price to C$43 from C$40

* Wheaton Precious Metals Corp

WPM: Stifel raises target price to C$90 from C$80

Following is a summary of research actions on Canadian companies reported by Reuters on Friday. Stock entries are in alphabetical order.

* Agnico Eagle Mines Ltd (Ontario)

AEM: Stifel raises target price to C$114 from C$104

* Altagas Ltd

ALA: JP Morgan raises target price to C$36 from C$33

* Artemis Gold Inc

ARTG: Stifel raises target price to C$14 from C$13

* Aya Gold & Silver Inc

AYA: Stifel raises target price to C$18 from C$16

* Barrick Gold Corp

ABX: Stifel raises target price to C$28.5 from C$27

* Canada Goose Holdings Inc

GOOS: Wedbush initiates coverage with outperform rating

* Canada Goose Holdings Inc

GOOS: Wedbush initiates coverage with price target C$21

* Canadian Natural Resources Ltd

CNQ: Raymond James cuts target price to C$48 from C$49

* Discovery Silver Corp

DSV: BMO initiates coverage with outperform rating; PT C$2

* Dundee Precious Metals Inc

DPM: Stifel raises target price to C$15.5 from C$14.5

* Eldorado Gold Corp

ELD: Stifel raises target price to C$25 from C$19.5

* Fiera Capital Corp

FSZ: CIBC raises target price to C$9 from C$7.25

* First Quantum Minerals Ltd

FM: BMO raises target price to C$22 from C$21

* First Quantum Minerals Ltd

FM: JP Morgan cuts target price to C$18 from C$20

* Franco-Nevada Corp

FNV: BMO raises target price to C$212 from C$210

* Franco-Nevada Corp

FNV: Stifel raises target price to C$200 from C$196

* Guardian Capital Group Ltd

GCG: CIBC cuts target price to C$47 from C$54

* IAMGOLD Corp

IMG: Stifel raises target price to C$6 from C$5.25

* Imperial Oil Ltd

IMO: Raymond James raises target price to C$94 from C$93

* K92 Mining Inc

KNT: Stifel raises target price to C$14.25 from C$13.75

* Kinross Gold Corp

K: Stifel raises target price to C$14.5 from C$11.5

* Lundin Mining Corp

LUN: BMO cuts target price to C$20 from C$22

* Lundin Mining Corp

LUN: Raymond James cuts target price to C$17 from C$18

* MAG Silver Corp

MAG: Stifel raises target price to C$21.25 from C$20.5

* Nanoxplore Inc

GRA: National Bank of Canada cuts target price to C$3.75 from C$4

* Orezone Gold Corp

ORE: Ventum Financial cuts target price to C$1.4 from C$1.5

* Orla Mining Ltd

OLA: Stifel raises target price to C$6.5 from C$6.25

* Osisko Gold Royalties Ltd

OR: Stifel raises target price to C$29 from C$28

* Prairiesky Royalty Ltd

PSK: ATB Capital Markets raises target to C$30 from C$28.5

* Quebecor Inc

QBR.A: Scotiabank raises target price to C$38 from C$37

* Rogers Communications Inc

RCI.A: Scotiabank raises target price to C$72 from C$71.5

* Sandstorm Gold Ltd

SSL: Stifel raises target price to C$10.25 from C$10

* Silvercrest Metals Inc

SIL: Stifel raises target price to C$12.5 from C$11.25

* TCP Energy Corp

TRP: JP Morgan raises target price to C$59 from C$58

* Teck Resources Ltd

TECK: BMO cuts target price to C$80 from C$85

* Tenaz Energy Corp

TNZ: Haywood Securities raises target price to C$8.50 from C$5.50

* TMX Group Ltd

X: CIBC raises target price to C$43 from C$40

* Wheaton Precious Metals Corp

WPM: BMO raises target price to C$67 from C$63

* Wheaton Precious Metals Corp

WPM: Stifel cuts to hold from buy

* Wheaton Precious Metals Corp

WPM: Stifel raises target price to C$90 from C$80

3 Best Agriculture ETFs to Buy for 2024

The majority of the world’s food source is sustained via agriculture, making it a recession-resistant industry. Similar to most other industries, agriculture was also impacted during the COVID-19 pandemic. However, the group staged a recovery in the last two years as commodity prices soared on the back of easing of lockdown restrictions, higher global demand, and the Ukraine-Russia war, which squeezed supplies of key agricultural products, including wheat and fertilizers.

Several agriculture stocks are trading near record highs, even though prices for commodities such as wheat and corn have pulled back in the last year. On the other hand, fertilizer manufacturers are wrestling with a strong U.S. dollar DXY, making their products more expensive in emerging markets in Asia and Latin America.

Given the agriculture industry is quite large, investors can consider gaining diversified exposure by investing in exchange-traded funds (ETFs), which lowers equity-specific investment risk by a significant margin.

Here are three agriculture ETFs you can buy right now.

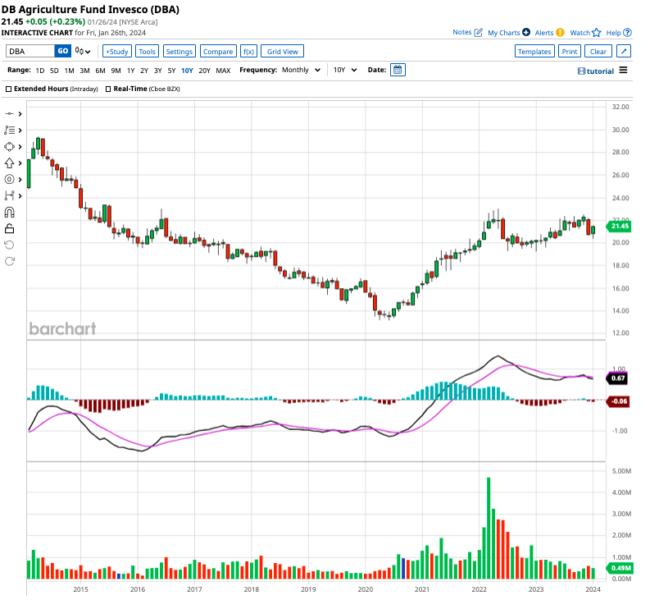

1. Invesco DB Agriculture Fund

The Invesco DB Agriculture Fund DBA is a popular option for those looking to gain exposure to agricultural commodities. The ETF invests in a basket of agricultural resources such as corn, soybeans, wheat, sugar, cocoa, coffee, cotton, and feeder cattle, offering investors diverse commodity exposure and a hedge against inflation.

With $780 million in assets under management, the DBA ETF has an expense ratio of 0.91%, which is relatively high. Down 27% from all-time highs, DBA has gained 28% in the last three years.

The fund also pays shareholders an annual dividend of $0.96 per share, translating to a yield of 4.5%.

2. VanEck Agribusiness ETF

The VanEck Agribusiness ETF MOO offers exposure to a basket of equities involved in the agriculture business. Its top five holdings include Deere & Co.

DE, Zoetis

ZTS, Bayer

BAYRY, Nutrien

NTR, and Corteva

CTVA, which account for 35.8% of the fund. While the majority of these holdings operate in developed markets, it also offers some exposure to emerging markets, such as Brazil and Malaysia.

The MOO ETF is positioned to benefit from the increase in global food demand and may offer a hedge against inflation, as agri-based commodities are generally the first to rise amid inflation.

With $927 million in assets under management, MOO has an expense ratio of 0.53%. This ETF trades 34% below all-time highs and has returned 68% in the past decade, after adjusting for dividends. MOO pays $2.24 in dividends annually for a forward yield of 3.1%.

3. iShares MSCI Agriculture Producers ETF

The final ETF on my list is the iShares MSCI Agriculture Producers ETF VEGI, which provides exposure to agricultural commodity prices via a portfolio of equities in the agri-business segment. These holdings include companies such as Deere & Co., Corteva, Archer-Daniels-Midland

ADM, Nutrien, and Lamb Weston

LW, which together account for 45% of the ETF's weight.

With $149 million in assets under management and an expense ratio of 0.39%, the VEGI ETF is the cheapest ETF on this list.

Down 25% from all-time highs, VEGI shares have gained 70% in dividend-adjusted gains since January 2014. The ETF pays shareholders an annual dividend of $0.55 per share, indicating a forward yield of almost 2.7%.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

沒有留言:

發佈留言