GPS Archives - John's Tech Blog (hagensieker.com)

(2) Easy One - YouTube ESP32 internet radio

Scatters and clusters of information. Those are my interests.

Market OverviewThe major stock indices experienced limited fluctuation in early trading as investors awaited key market events. The advance-decline line showed a slight preference for advancers at both the NYSE and Nasdaq. Following the Federal Open Market Committee's (FOMC) unanimous decision to maintain the fed funds rate at 5.25-5.50%, markets initially showed little reaction. However, stocks rallied after Fed Chair Powell indicated that a rate hike was unlikely in the near future. This statement prompted a drop in market rates, with major indices subsequently rising by over 1.0%. Interest Rates and BondsThe yield on the 2-year note, highly sensitive to fed funds rate changes, decreased by 11 basis points to 4.94%. The 10-year note yield also fell by nine basis points to 4.60%. Despite these declines, a late-day loss of momentum, driven by uncertainties about prolonged high rates, left major indices close to their pre-event levels. Stock PerformanceThe Dow Jones Industrial Average (DJIA) saw a slight increase of 0.2%, while both the S&P 500 and Nasdaq Composite recorded losses of 0.3%. Amazon.com (AMZN, Financial) supported the broader market with a 2.3% increase in its stock price. Conversely, significant earnings-related declines were seen in CVS Health (CVS, Financial), Starbucks (SBUX, Financial), and Skyworks Solutions (SWKS, Financial), which notably impacted the market. Economic Data InsightsRecent economic reports present a mixed scenario with weakening manufacturing activity and rising prices:

Upcoming Economic DataKey reports to be released include:

Global Markets and CommoditiesEuropean and Asian markets showed mixed closures while commodities like crude oil and natural gas saw price adjustments. Precious metals like gold and silver reported gains, whereas copper experienced a slight decline. Guru Stock PicksJohn Hussman has made the following transactions: Baillie Gifford has made the following transactions: Today's NewsQualcomm (QCOM, Financial) saw its shares jump 4.5% after providing optimistic third-quarter earnings and revenue forecasts that surpassed analysts' expectations. This positive outlook follows a robust performance in the second quarter, where Qualcomm reported earnings of $2.44 per share and revenue of $9.39 billion. The company's automotive sales notably increased by 35%, contributing to the overall strong results. This news also positively impacted other semiconductor stocks like Broadcom (AVGO), Intel (INTC), and Nvidia (NVDA). Google (GOOG, GOOGL) announced a significant reorganization, which includes laying off at least 200 employees from its core teams. The restructuring will also see some positions being relocated to India and Mexico. This move is part of a broader trend of job cuts across the company, affecting various departments throughout the year. The Federal Trade Commission is close to approving Exxon Mobil's (XOM, Financial) acquisition of Pioneer Natural Resources (PXD, Financial) for $60 billion. The approval is contingent on the condition that Pioneer's founder, Scott Sheffield, will not join Exxon's board. This decision comes amidst ongoing legal challenges and allegations of collusion among oil producers in the Permian Basin. UnitedHealth Group (UNH, Financial) CEO Andrew Witty disclosed that the company paid a $22 million ransom following a cyberattack on its Change Healthcare IT systems. This breach disrupted services nationwide, affecting numerous healthcare providers. Witty testified before Congress, outlining the steps UnitedHealth has taken to enhance security, including implementing multifactor authentication across its systems. Apple (AAPL, Financial) is gearing up to release its second-quarter earnings, with analysts forecasting a decline in revenue and earnings per share. This report is highly anticipated, especially considering Apple's recent underperformance compared to its tech peers and its efforts to integrate generative AI into its products. Amazon (AMZN, Financial) continues to expand its generative AI capabilities, which are now generating significant revenue. This development is part of Amazon's broader strategy to strengthen its cloud computing platform, AWS, by integrating advanced AI features that appeal to developers and businesses. Carvana (CVNA, Financial) reported a record net income of $49 million for the first quarter, with a notable increase in revenue and retail units sold. The company anticipates further growth in the upcoming quarter, reflecting a stable market environment and improved economic conditions. GuruFocus Stock Analysis

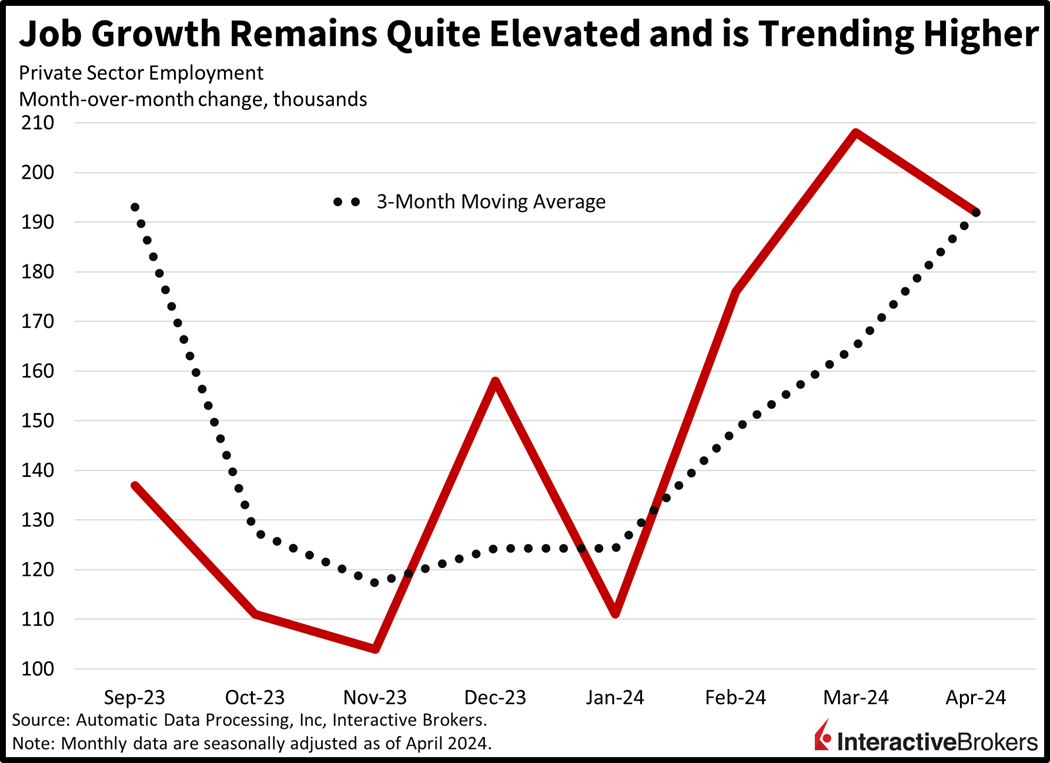

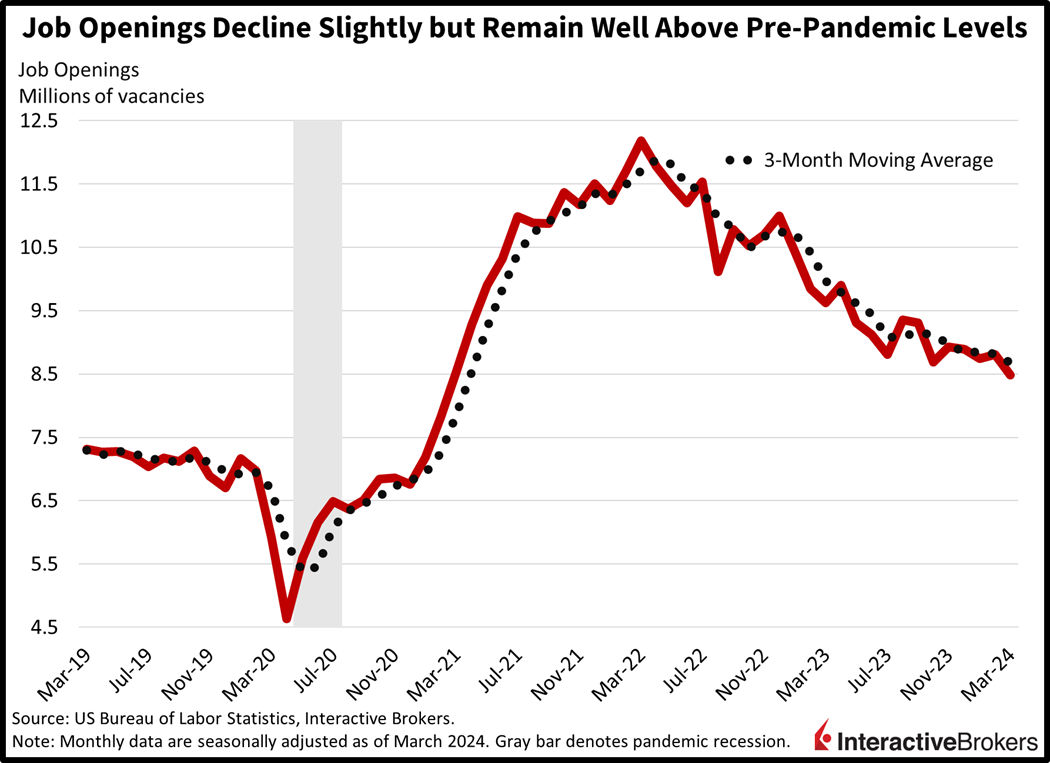

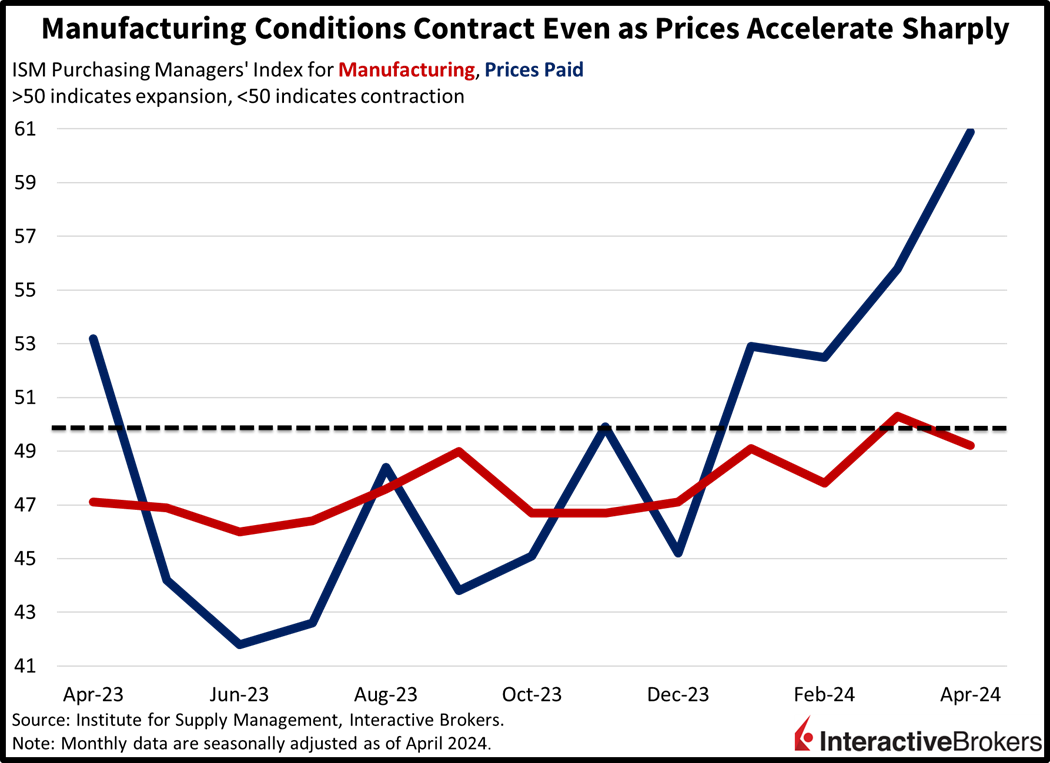

may 1 2024 Stocks are crying wolf as investors await Fed Chair Powell’s update on monetary policy this afternoon and digest an abundant buffet of corporate earnings and economic data. Comments from executives and economic statistics are providing mixed messages, however, with some firms worried about consumer health while others appear quite satisfied with shoppers’ momentum. As for job figures, ADP is reflecting persistent labor market strength while ISM and JOLTS are telling a slightly different tale. ADP Reports Another Month of Strong HiringThe private sector maintained a strong hiring pace last month, according to payroll processing firm ADP. Employers added 192,000 jobs, beating estimates of 175,000 but slightly less than March’s gain of 208,000. Strength was widespread with ten out of eleven sectors increasing headcounts. Leading the charge were the leisure and hospitality category, with 56,000 additions, and the construction category, with 35,000 hirers. Other gainers and numbers of additions included the following: Education/health services, 26,000 Trade/transportation/utilities, 22,000 Professional/business services, 16,000 Manufacturing, natural resources/mining and other services all gained less than 10,000 The information category was the sole decliner with a loss of 4,000.  Companies Big and Small Add WorkersJob growth also extended across business sizes, with large (500+employees), mid (50-499) and small (1-49) firms expanding rosters by 98,000, 62,000 and 38,000. Wage figures remained a problem for the inflation outlook, however, with the median year-over-year (y/y) compensation change for job stayers and job changers coming in at 5.1% and 10%. The former maintained an unchanged growth rate from March while the latter accelerated sharply from 7.6% y/y. Job Openings DeclineLabor vacancies slipped slightly in March, according to the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics. Job openings came in at 8.488 million, much lighter than the 8.69 million projected and the 8.813 million from February. In a sign of reduced confidence from workers being able to replace their current employers, job quits fell sharply to 3.329 million from 3.527 million in the prior month.  Manufacturing Goes Back in ReverseManufacturing conditions reentered contraction territory last month, according to the Institute of Supply Management (ISM). Prices, however, accelerated strongly despite a reduction in orders and staffing. The ISM’s Purchasing Managers’ Index (PMI) for manufacturing slipped to 49.2 for April, missing the expansion/contraction threshold of 50. Last month’s figure declined from 50.3 in March and missed expectations for 50. Weighing on the headline were contractions in demand, employment, and backlogs, which came in at 49.1, 48.6 and 45.4. Production offset some of the weakness, however, with a score of 51.3. Prices, meanwhile, jumped to 60.9, accelerating fiercely from the previous month’s 55.8.  Consumers Rely on Credit while AI Boosts Tech ResultsConsumers are continuing to rely on credit cards for shopping and traveling while restaurants are reporting mixed results with sales. In the tech sector, cloud computing, artificial intelligence (AI) and advertising are helping to support earnings, although in at least one instance, supply chain issues have surfaced. The following highlights elaborate on these prevalent themes from recent earnings calls:

Investors Dump Risk AssetsRisk assets are getting creamed as we await Chair Powell’s run from the dugout to the mound. Investors are clamoring for protection as downside hedges are getting pricier alongside safe havens, with gold and Treasuries catching bids. For major stock indexes, though, only the Dow Jones Industrial Average is higher. The Nasdaq Composite, S&P 500 and Russell 2000 benchmarks are lower by 0.6%, 0.3% and 0.3%. Sectoral participation is not as bad, however, with 6 out of 11 segments higher this session. Leading the charge upward are communication services, utilities and materials sectors, which are gaining 1%, 0.8% and 0.5%. Energy, consumer discretionary and technology are collectively pushing equity benchmarks lower, however, with the sectors losing 1.5%, 0.9% and 0.8%. Energy is suffering from a sharp decline in oil prices as WTI crude is down 2.7%, or $2.17, to $79.26 per barrel. Increased optimism about a potential Middle East ceasefire and a significant increase in stateside inventories are to blame. Gold and copper are higher by 0.9% and 0.1%, meanwhile. In fixed-income and currency land, the 2- and 10-year Treasury maturities are trading at 5.01% and 4.66%, 3 basis points (bps) lower on the session for both instruments. The dollar is paring some of yesterday’s upside as traders re-evaluate recent hawkish moves in yields while awaiting further guidance from Powell today. The US currency is down versus most of its major counterparts including the euro, yen, yuan and Aussie and Canadian dollars. The greenback is gaining slightly relative to the pound sterling and franc though. Will Powell Save the Day?Chair Powell is truly unpredictable when he starts taking questions from the crowd following his review of economic conditions. Sometimes his comments attempt to strike a balance between the committee’s statement regarding the direction of monetary policy and his presentation. But risk assets selling off prior to the chair approaching the mound is emblematic of what the markets want, which is more upside. Will Powell be sensitive to the hawkish repricing across equities and fixed-income and use that opportunity to take it easy? Or will he talk economic pain, Volcker and the Fed sticking to its 2% inflation goal, hell or high water? As far as what I’m expecting: a hawkish statement, a sympathetic Powell. Visit Traders’ Academy to Learn More About ISM-Manufacturing and Other Economic Indicators April 30 2024 Today saw a significant downturn in the stock market, with the Nasdaq Composite experiencing a 2.0% drop, more than the S&P 500 and Dow Jones Industrial Average, which fell by 1.6% and 1.5% respectively. The decline was exacerbated towards the close due to a wave of end-of-month selling, reflecting a broader trend of de-risking throughout April. Notable losses were recorded by NVIDIA (NVDA) and Meta Platforms (META), despite both companies showing early gains during the day. NVIDIA closed down at $864.02, a 1.5% decrease, after initially peaking with a 1.2% gain. Similarly, Meta Platforms ended the day at $430.17, down 0.6%, after an early increase of 1.6%. The market's downward movement was influenced by a rise in market rates, following a report that showed a 1.2% increase in Q1 employment compensation costs, exceeding the expected 1.0%. This has added to the ongoing concerns about persistent inflation and potential delays in interest rate cuts by the Federal Reserve. Despite widespread losses across sectors, a few companies bucked the trend due to positive earnings reports. Eli Lilly (LLY) saw a significant rise, closing at $781.10, up 6.0%. Corning (GLW) and 3M (MMM) also posted gains, closing up 5.0% and 4.7% at $33.38 and $96.51, respectively. Guru Stock PicksElfun Trusts has made the following transactions: Fairholme Fund has made the following transactions: Fairholme Focused Income Fund has made the following transactions: Today's NewsAmazon (AMZN, Financial) reported a strong first quarter, with earnings per share of $0.98, surpassing the consensus estimate of $0.83. The company's revenue reached $143.3 billion, up 12.5% year-over-year, beating expectations by $750 million. Notably, the North America segment saw a 12% increase in sales, while AWS sales grew by 17%. However, Amazon's guidance for the second quarter suggests a slowdown in growth, with net sales projected to be between $144.0 billion and $149.0 billion, slightly below the consensus of $150.09 billion. Super Micro Computer (SMCI, Financial) also exceeded expectations with a third-quarter non-GAAP EPS of $6.65, outpacing the consensus by $1.08. However, its revenue of $3.85 billion, a 200.8% increase year-over-year, fell short of expectations by $50 million. The company has raised its revenue guidance for fiscal year 2024, now expecting between $14.7 billion and $15.1 billion, against a consensus of $14.59 billion. Advanced Micro Devices (AMD, Financial) posted a modest earnings beat with a first-quarter non-GAAP EPS of $0.62, slightly above the expected $0.61. The company's revenue of $5.47 billion, up 2.2% year-over-year, also surpassed forecasts. AMD's data center segment was particularly strong, with revenue up 80% due to sales of its AMD Instinct GPUs and EPYC CPUs. Starbucks (SBUX, Financial) faced a challenging quarter with its Q2 non-GAAP EPS of $0.68 missing estimates by $0.12 and revenue declining 1.8% year-over-year to $8.56 billion. Global comparable store sales decreased by 4%, with a notable 11% decline in China. Pinterest (PINS, Financial) delivered a positive surprise with its first-quarter results, achieving a non-GAAP EPS of $0.20, which beat estimates by $0.07. Revenue grew 22.8% to approximately $740 million, driven by a 12% increase in global monthly active users to 518 million. Caesars Entertainment (CZR, Financial) reported a decline in Q1 revenue by 3.2% year-over-year to $2.74 billion. The company highlighted profitability in its digital operations but noted a decrease in adjusted EBITDA across its Las Vegas and regional properties. W.P. Carey (WPC, Financial) disclosed first-quarter financials that slightly missed expectations, with FFO of $1.14 per share and revenue of $389.8 million, down 8.9% year-over-year. The company reaffirmed its full-year AFFO guidance, expecting continued investment activity. GuruFocus Stock Analysis

April 26. 2024 FriMarket OverviewThe stock market experienced a mixed day, with major indices recovering from significant early losses to close with only modest declines. Initially, the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average saw drops of 1.6%, 2.3%, and 1.8% respectively, but ended the day with losses ranging from 0.5% to 1.0%. The early downturn was influenced by negative earnings reactions for key companies and concerns over economic growth and Federal Reserve rate policies. Market Movers

Sector PerformanceDespite early declines, several sectors managed to close with gains:

Market Indices Year-to-Date Performance

Economic Data InsightsToday's economic data highlighted ongoing strength in the labor market and presented a mix of weaker growth and higher inflation, hinting at potential stagflation concerns. Notably:

Looking AheadKey economic reports to watch include March Personal Income and Spending, PCE Prices, and the Final April University of Michigan Consumer Sentiment Index. Additionally, international market performances and commodity prices will continue to influence market sentiment. Guru Stock PicksSmead Value Fund has made the following transactions:

Today's NewsfAlphabet (GOOG, GOOGL) experienced a significant surge, climbing 12% following its impressive first-quarter earnings report. The tech giant surpassed analyst expectations with a 15% revenue increase, highlighted by a strong performance in YouTube ads and continued momentum in its Cloud segment. CEO Sundar Pichai emphasized the company's robust performance across Search, YouTube, and Cloud, marking the beginning of its "Gemini era." Intel (INTC, Financial), on the other hand, faced a downturn as its future outlook failed to meet market expectations. Despite reporting better-than-anticipated results for the first quarter, its guidance for the upcoming quarter fell short of analyst predictions, causing shares to drop over 6% in extended trading. This report marks Intel's first under a new reporting structure, with notable growth in its client computing revenue. Microsoft (MSFT, Financial) also made headlines with its third-quarter earnings, surpassing expectations with a 17.1% year-on-year revenue increase. The company's performance was driven by growth across its productivity, business processes, and cloud segments, with shares rising 5%. Microsoft's forward-looking guidance is keenly awaited by investors. Roku (ROKU, Financial) reported a narrower-than-expected loss for its first quarter, with revenue increasing 19% year-over-year. The company saw a significant rise in platform revenue and streaming households, contributing to an 11% increase in its stock price. Snap (SNAP, Financial) announced a notable 24% jump in its shares after reporting a 20.3% year-over-year revenue increase in the first quarter. The company exceeded expectations with its non-GAAP EPS and provided an optimistic revenue guidance for the next quarter, reflecting strong advertiser engagement and growth in Snapchat+ subscribers. Teladoc Health (TDOC, Financial) shared its first-quarter results, showing a slight revenue increase and a narrower loss than expected, leading to a 3.53% rise in its shares. The company offered a positive outlook for the coming quarter, highlighting growth in its Integrated Care segment. Atlassian (TEAM, Financial) outperformed expectations with a 30% year-on-year revenue increase in the third quarter, driven by strong subscription revenue growth. The company's shares responded positively to the news, reflecting investor confidence in its long-term prospects. Paramount Global (PARA, Financial) experienced a 4% decline amid reports of nearing a deal with Skydance Media, valuing the latter at $5B. The potential merger aims to strengthen Paramount's position in the entertainment industry. Gilead Sciences (GILD, Financial) reported a 5.4% revenue increase in the first quarter, driven by sales in its HIV, Oncology, and Liver Disease segments. The company updated its full-year guidance, reflecting confidence in its product lineup. KLA (KLAC, Financial) announced third-quarter results that beat expectations, with a slight year-over-year revenue decrease. The company provided optimistic guidance for the fourth quarter, expecting revenue and earnings per share to increase. Western Digital (WDC, Financial) surpassed third-quarter financial expectations, reporting a 23.6% year-over-year revenue increase. However, shares fell nearly 5% as the company projected a cautious outlook for the next quarter. Hertz Global Holdings (HTZ, Financial) reported a disappointing first-quarter performance, missing profit estimates and highlighting increased vehicle depreciation costs. Shares hit a 52-week low following the announcement. Edwards Lifesciences (EW, Financial) delivered strong first-quarter results, with a 9.6% revenue increase driven by growth in TAVR and TMTT sales. The company reaffirmed its full-year earnings guidance, signaling optimism for continued growth. L3Harris Technologies (LHX, Financial) reported a 16.6% revenue increase in the first quarter, exceeding market expectations. The company raised its full-year earnings guidance, reflecting strong order intake and operational efficiency. Kinsale Capital (KNSL, Financial) announced a 41.7% year-over-year revenue increase for the first quarter, with significant growth in gross written premiums and net investment income. The company's strong performance led to an increase in its shares. T-Mobile US (TMUS, Financial) reported a slight year-over-year revenue decrease in the first quarter but exceeded earnings expectations. The company raised its full-year guidance, driven by strong customer additions and improved core adjusted EBITDA. GuruFocus Stock Analysis

Market Overview

Economic Indicators and Market Response

Stocks in Focus

Global Markets and Commodities

Guru Stock Picks

Today's News

GuruFocus Stock Analysis

APRIL 22 2024Market Summary

Notable Stock Performances

Earnings Week Ahead

Market Highlights

Economic Indicators and Market Outlook

Global Markets and Commodities

Guru Stock Picks

Today's News

GuruFocus Stock Analysis

Nike Reverses Course as Innovation Stalls and Rivals Gain Ground — WSJ

By Inti Pacheco In late February, Nike boss John Donahoe led a virtual all-hands meeting where he delivered a message to his staff: The company wasn't performing at its best and he held himself accountable. Two weeks earlier, Nike had announced it would lay off more than 1,600 employees. Now, as the CEO spoke at the meeting, critical comments started to fill the chat window on the Zoom call while more than 20,000 employees watched. "Accountability: I do not think that word means what you think it means, " an employee wrote. "If this is cost cutting, how about a CEO salary cut?" another wrote. Soon a cascade of laughing emojis filled the screen. Some colleagues warned others that their posts weren't anonymous and the chat might be monitored. The attacks went on for several minutes. "I hope Phil is watching and reading this," an employee wrote, referencing the retired Nike co-founder Phil Knight. The virtual protest illustrated the depths of the dissatisfaction within the sneaker giant and concern for its strategy. "How did we actually get here?" wrote one product manager. Since the pandemic, Nike has lost ground in its critical running category while it focused on pumping out old hits and preparing for an e-commerce revolution that never came. The moves, current and former employees say, have eroded a culture of innovation and edginess that made Nike one of the world's best-known brands. Donahoe had told The Wall Street Journal in 2020 that his No. 1 priority when taking over the company was "don't screw it up." Four years later, the company is unwinding key elements of the CEO's strategy that have backfired as a growing number of upstarts nip at its heels. Among the reversals: As Covid raged and more shopping moved online, Nike cut ties with longtime retail partners such as DSW and Urban Outfitters and tried selling more merchandise directly to consumers. It is now asking some of those stores for help clearing out its overstuffed shelves and warehouses. "I would say we got some things right and some things wrong," Donahoe said Thursday, in an interview at Nike's Beaverton, Ore., headquarters. Losing its roots The strategic missteps have animated a debate inside the company about its identity. In its zeal to boost digital sales, some current and former employees say, Nike veered from its roots as a maker of cutting-edge footwear for serious athletes. It has opened itself to competition from newcomers such as On and Hoka, which have borrowed from the playbook that fueled Nike's rise — including focusing on sport over lifestyle, and taking risks on innovation. Nike's once torrid growth has stalled. Sales for the quarter ended Feb. 29 were flat compared with a year earlier, and shares in the company have declined 24% over the past year, compared with a 19% gain in the S&P 500. Donahoe in the interview acknowledged the brand lost its "sharp edge" in sports and needed to boost its "disruptive innovation pipeline." The CEO said the brand's marketing got fragmented and that with people going back to bricks-and-mortar stores, it was clear Nike needed to invest in its retail partners. Nike executives said in interviews that the company became too cautious after the pandemic and overly reliant on older products that were reliable sellers. They said the company has made significant changes in recent months to refocus it on putting out cutting-edge footwear. "We were serving consumers what they know and love," said John Hoke, Nike's recently named chief innovation officer. "The job is to of course do that but also to show them something new, take them someplace new." Donahoe said Nike is going through a period of adversity and layoffs that has created uncertainty, but that the company will get through it. "Our employees have been through a lot," he said. "Nike is actually at its best, like a great sports team, when our backs are against the wall." Knight, who is chairman emeritus of the board and the company's largest shareholder, said in a statement that Donahoe has his "unwavering support." Donahoe said employees' responses to the all-hands meeting reflected one of Nike's biggest strengths: how much its staff cares about the company. "We welcome and encourage that," Donahoe said. Shift into digital Donahoe took over Nike just before the pandemic, at a delicate time. Though he inherited a market leader and one of the world's best-known brands, Nike was seeking a refresh after it dealt with complaints about its workplace culture that led to a management shake-up. The Evanston, Ill., native had been CEO of eBay, where he doubled the e-commerce platform's revenue during a seven-year stint that ended in 2015. After a sabbatical — during which he says he had a life-altering experience at a 10-day Buddhist silent meditation retreat — Donahoe went on to run cloud-computing company ServiceNow. When he took the helm of Nike in early 2020, his marching orders from Mark Parker, his predecessor and current executive chairman, and Knight were clear. He was to turn the world's biggest shoe maker into a tech company more directly connected to consumers through its own apps, which in turn collect valuable data from shoppers. Parker said when he stepped down that Donahoe was the right candidate to lead Nike's digital transformation. Donahoe was just the fourth CEO in the company's more than 50-year history. The only other outsider to get the job said he was ousted in 2006 after a short stint because he focused too much on the numbers. Donahoe started out with a 100-day global listening tour that was cut short after a month when the pandemic hit. Covid lockdowns fueled a surge in online shopping. Digital channels accounted for 30% of Nike's sales in May 2020, about three years ahead of schedule. Donahoe saw it as an acceleration of an inevitable shift and adjusted Nike's plans accordingly. A few months in, he redoubled the company's bet that it could make more money by selling products directly to consumers through its stores and digital channels. He said he believed digital sales would reach 50% of the business, and Nike should transform faster to define the marketplace of the future. It was time to act. By late 2020, Nike dropped about a third of its sales partners and sold less merchandise to clients such as Foot Locker, DSW and Macy's. There had been a plan to phase out wholesale clients since 2017, but with digital sales growing quickly, Donahoe said there was a need for urgency. Executives were divided over whether Nike's own stores, which include both factory outlets and specialty shops selling higher-priced new releases, could fill the sales void left by the retailers the company was cutting out. In meetings, finance chief Matt Friend and Nike president Heidi O'Neill supported the aggressive exit from retail that Donahoe was pushing, while others favored a slower transition, people familiar with the matter said. Some executives felt the specialty stores in particular worked better as marketing tools and that cutting off so many retailers so fast would backfire, the people said. Donahoe and his allies prevailed. Nike teams were tasked to come up with a new global supply-chain process. Selling directly to consumers increased the company's liabilities, including by shifting storage and shipping costs from wholesalers to Nike. The company would also absorb the losses from discounts if the merchandise didn't sell quickly and inventory piled up. One of the casualties of Donahoe's 2020 transformation was a multibillion-dollar operation dedicated to developing footwear sold for under $100. The company deprioritized more-affordable footwear that usually sold to the sales partners that Nike was leaving behind. The move left Nike skewed toward higher-priced shoes. The first evidence of cracks in Nike's new approach appeared early last year when Foot Locker Chief Executive Mary Dillon said during an earnings call the brand had reversed course and was sending the retailer a wider assortment of Nike products. By the summer, Macy's and DSW were saying the same thing. The message was clear: Nike needed help selling merchandise. Nike veterans said cutting off wholesale clients was one of the biggest mistakes the company has ever made. After digital sales hit the 30% of the total mark early in the pandemic, they dropped back, and haven't reached that level since — let alone the 50% target Donahoe had foreseen. Donahoe said in the interview the goal at the time was to lean more on specific partners, such as Dick's Sporting Goods and JD Sports, which he considers to be more aligned with Nike, rather than make a dramatic shift in strategy. Nike deprioritized making lower-priced shoes because of supply-chain disruptions during the pandemic, but it is now making more of those products, he said. "I don't see it as a reversal of the strategy," Donahoe said of the return to more retail chains. "I see it as an adjustment." Rising competition Competitors have been using the sneaker giant's playbook at its expense. Smaller brands like On, Hoka and New Balance have captured significant pieces of the market for both hard-core and everyday runners — and their popularity is spreading to the mainstream. Often quoting Knight, the Nike co-founder, former employees said the principle always was to first capture the market for hard-core athletes with innovative performance gear, and the casual consumer would follow. In early February, Hoka owner Deckers Outdoor tapped Nike alums to take over both the parent company and the shoe brand. Hoka had $1.4 billion in sales for the year through March 2023, compared with about $352 million three years earlier. Hoka didn't respond to requests for comment. "When you're the biggest, there's always going to be people coming after you," Donahoe said. Competitors give Nike an incentive to try to understand what consumers want and to figure out how to come up with something bold and different, he said. Nike still dwarfs its competition. During Donahoe's tenure, Nike sales have grown 31% to $51 billion in 2023. That is more than double the results of Adidas, its closest competitor by far. New Balance reported sales reached $6.5 billion last year, and upstart On almost hit the $2 billion mark. The race to hit revenue targets came at a cost for Nike. Executives turned to the brand's lucrative franchises, including Air Jordan and Dunk, and ramped up the releases. The strategy diluted the exclusivity prized by die-hard Nike sneaker shoppers. Donahoe said in the interview that Nike ramped up production to meet demand on its SNKRS app, which fans use to buy the latest limited releases. In early 2021, Nike was meeting less than 5% of the demand for some releases on the app and consumers were frustrated, Donahoe said, adding the goal is to meet something closer to 20% of demand for the exclusive styles. Now, sneaker resellers say they have seen release after release of Nike's limited-edition kicks that don't sell out on the SNKRS app, and that in the secondary market — a space that the brand closely monitors — prices are tanking. Nike executives in March said they would pull back on franchise releases. Donahoe said "franchise management has always been something Nike has done." Nike's digital sales, a figure that includes direct and partner e-commerce sales, declined for the quarter ended Feb. 29. Friend, the finance chief, told analysts in March that Nike expects total sales to decline at least until the end of this year. Struggle for innovation The pursuit of sales growth from limited-edition sneaker releases led Nike to neglect its running category, long considered the core product of the company, former employees said. This month in Paris, Nike unveiled its new product line for the Olympics, including running shoes with a new cushioning system that uses the company's Air technology. In interviews at the event, executives said the company had become somewhat risk-averse during the pandemic, when working remotely stifled creativity. Martin Lotti, chief design officer, said the company had spent too much time looking to its past. "If you drive a car just by looking in the rear view mirror, that's not a good thing," Lotti said. "The bigger opportunity is the windshield." Current and former Nike executives believe the future of the company is in its app ecosystem, like the Nike Training and Running Club or its SNKRS app, and the data it can harness from them to help design and sell products. Inside the company, leaders have long tried to draw comparisons to Apple when talking about Nike's innovation and design culture. The sneaker giant has been acquiring smaller data analytics startups for at least a decade. Two years ago, it also bet on the NFT craze. One of Nike's biggest tech investments is a multibillion-dollar process to migrate multiple software programs into one single system. The new platform, known as S/4HANA, is still not operational and is three years behind schedule. The software is designed to help day-to-day operations, such as procurement and inventory management, and speed up digital sales. As part of its accelerated focus on digital sales, Nike hired about 3,500 people to join what the company calls its global technology group, which includes consumer insights and data analytics. Executives at the time said they were investing in "demand sensing," "insight gathering" and a new inventory system. Former Nike employees with knowledge of the consumer insights strategy said executives misinterpreted the data in ways that overestimated demand for retro franchises. During February's round of layoffs executives trimmed layers of management across the company's insights and analytics teams. A large technology innovation team, tasked with developing software to implement Apple's new Vision Pro augmented reality system in day-to-day design tasks, and a separate artificial intelligence team were also eliminated. Executives at Nike say it is entering a "supercycle" of innovation and that the new Air line of products enhances athlete performance. At the Olympics preview event this month, the company took over the historic Palais Brongniart in central Paris with a three-day event to unveil its new Air line. Guests wandered through a museum-like, conveyor-belt installation highlighting Nike's product evolutions and research and development programs. Athletes including runners Sha'Carri Richardson and Eliud Kipchoge modeled the new gear. Retired tennis great Serena Williams narrated the company's lavish introduction video before appearing on stage. Outside, 30-foot orange statues of Nike-sponsored athletes including LeBron James, Kylian Mbappé and Victor Wembanyama stood guard. Donahoe's relationship with Knight goes back to the early 1990s, when he was a Bain consultant on Nike projects. He joined the Nike board in 2014 and is one of the directors of an entity Knight created called Swoosh LLC, which holds roughly $22 billion worth of Nike shares and controls a majority of Nike's board seats. Donahoe calls Knight his "greatest hero in business." The current CEO said he meets with his predecessor, Parker, every week. Donahoe said that he and Parker share an approach to management he calls "servant leadership" that was embodied by some of his sports heroes, including basketball coaches Phil Jackson, John Thompson, Mike Krzyzewski and Tara VanDerveer. "It's never been about me. It's about your players. And are you doing everything you can to allow your players to make the adjustments to win? And when you have a win it's about the players and when you have a loss you say it's on me, right?," he said. "And that's what I've always tried to embody, including during this period of time." This week, Donahoe is facing another test: the company is notifying several hundred more workers whose jobs are being cut.

Write to Inti Pacheco at inti.pacheco@wsj.com Weekly Stock Market OverviewThe stock market experienced a downturn this past week, with significant indexes reporting losses. The Russell 2000 decreased by 2.8%, the S&P 500 fell by 3.1%, and the Nasdaq Composite saw a 5.5% drop. The Dow Jones Industrial Average, however, remained relatively stable, showing no significant change over the week. Key Influencers on Market Performance

Market Sentiment and Sector PerformanceMarket sentiment was affected by various factors including rising interest rates, geopolitical tensions, and sector-specific weaknesses. The information technology, consumer discretionary, and communication services sectors faced the largest declines due to weakness in mega cap stocks. Conversely, the consumer staples, utilities, and financial sectors managed to record gains. Economic Indicators and Market ResponseEconomic data released throughout the week had mixed impacts on the market. Retail sales showed continued consumer spending, while housing starts and building permits indicated a supply-constrained housing market. Industrial production saw growth, driven by manufacturing output. However, existing home sales were weak, reflecting challenges such as high prices and low inventory. Daily Market ActionsThe week was characterized by fluctuations, with initial buy-the-dip actions fading as sessions progressed. Notably, semiconductor stocks and mega cap stocks continued to influence market dynamics significantly. Earnings reports from companies like UnitedHealth (UNH, Financial), Travelers (TRV, Financial), J.B. Hunt Transport (JBHT, Financial), and United Airlines (UAL, Financial) also played a role in daily market movements. Guru Stock PicksRobert Olstein has made the following transactions: Today's NewsSuper Micro Computer (SMCI, Financial) experienced a significant drop, nearly 23%, as it announced its fiscal third-quarter results will be released on April 30, causing a ripple effect in the semiconductor sector. Nvidia (NVDA, Financial) also saw a sharp decline of more than 10%, following a broader sell-off in AI-related stocks. This downturn reflects growing concerns over artificial intelligence spending and its impact on quarterly results. Broadcom (AVGO, Financial), Marvell Technology (MRVL, Financial), and Monolithic Power Systems (MPWR, Financial) similarly faced losses, highlighting a challenging day for semiconductor investments. UnitedHealth Group (UNH, Financial) is under scrutiny as the U.S. Department of Justice explores an antitrust case that could span years. This development follows increased attention on monopolization cases within the healthcare sector, affecting major companies like Apple (AAPL, Financial), Google (GOOG, Financial), Amazon (AMZN, Financial), Visa (V, Financial), and Live Nation (LYV, Financial). DoorDash (DASH, Financial) announced the addition of Jeffrey Blackburn to its board of directors, effective May 6. Blackburn's extensive experience at Amazon (AMZN, Financial) is expected to bolster DoorDash's strategic initiatives, signaling continued growth and innovation within the delivery service sector. Netflix (NFLX, Financial) faced a downturn after announcing it would cease reporting subscriber numbers, a move that has sparked investor concern despite the company's subscriber growth and financial performance exceeding expectations. This decision contributed to a broader market unease, affecting technology stocks and the overall market sentiment. Verizon (VZ, Financial) is poised to release its first-quarter results, with expectations set for a slight revenue decline and a decrease in earnings per share. The telecom giant's performance is closely watched, given its significant role in the wireless market and potential benefits from recent interest rate declines. Banking regulators are considering a proposal that would require large banks to defer executive compensation and reclaim bonuses in case of significant losses. This measure aims to align executive incentives with long-term financial stability and risk management practices. Carnival (CCL, Financial) has announced a strategic financial move to issue €500 million in senior unsecured notes, aiming to reduce its debt interest expenses. This decision reflects the company's efforts to improve its financial health and operational efficiency in the competitive hospitality and leisure industry. EHang Holdings (EH, Financial) has filed for a mixed shelf offering, indicating its plans for future capital raising activities. This move suggests EHang's ongoing commitment to expanding its eVTOL (electric vertical takeoff and landing) technology and market presence. Amid a challenging week for the stock market, semiconductor companies faced significant pressure, highlighting concerns over AI spending and its impact on future earnings. This sector's performance, along with developments in healthcare antitrust cases and strategic corporate board appointments, shaped today's market narrative. GuruFocus Stock Analysis

| ||||||||||||||||||

Market SummaryToday's trading session mirrored the pattern seen throughout the week at the NYSE, with early gains dissipating due to a lack of strong buying interest. This was also reflected in a slight dominance of decliners over advancers across both the NYSE and Nasdaq. The major indexes ended mixed, with the S&P 500, Nasdaq Composite, and Russell 2000 posting their fifth consecutive loss, while the Dow Jones Industrial Average managed a marginal gain. Impactful StocksNotable movements in heavily-weighted stocks contributed significantly to the day's market dynamics. Microsoft (MSFT, Financial), Amazon.com (AMZN, Financial), and Tesla (TSLA, Financial) experienced declines, with Tesla reaching a new 52-week low. Their performances had a notable impact on the overall index performance, particularly affecting the S&P 500 and Nasdaq Composite. Sector Performance

Earnings HighlightsResponses to recent earnings announcements were mixed, affecting stock performances. Genuine Parts (GPC, Financial) and Elevance Health (ELV, Financial) stood out with significant gains post-earnings, whereas Las Vegas Sands (LVS, Financial) and Equifax (EFX, Financial) faced steep declines following their earnings reports. Market Rates and Economic DataRising market rates posed a challenge to stocks, with both the 10-yr and 2-yr note yields increasing. This movement came in the wake of the weekly jobless claims report and a better-than-expected Philadelphia Fed survey for April, indicating a solid labor market and potential for economic growth. Additionally, existing home sales data highlighted challenges in the housing market, including high prices and low inventory. Global MarketsOverseas markets saw modest gains, with European and Asian markets closing higher. This global perspective provides context to the day's trading activity and its potential implications on domestic markets. Commodity PricesCommodities experienced mixed movements, with crude oil seeing a decline, while gold increased in value. Natural gas, silver, and copper prices also saw changes, reflecting broader market trends and investor sentiment. Guru Stock PicksCatherine Wood has made the following transactions: Today's NewsNetflix (NFLX, Financial) experienced a notable rise and subsequent pullback in early after-hours trading, following a first-quarter earnings report that exceeded expectations in subscriber growth and financial forecasts. The streaming giant reported a 3.6% increase, showcasing double-digit gains and a decision to cease reporting subscriber numbers in the future. With global streaming paid net additions reaching 9.33M and total global paid membership soaring to 269.6M, Netflix outperformed Bloomberg's consensus of 4.84M additions. Despite a decrease from the previous quarter's 13.12M additions, the year-over-year growth rate of 16% marked a significant acceleration, especially for a traditionally slow quarter. Additionally, Netflix's revenue saw a 15% increase to $9.37B, with operating income and margin also experiencing substantial growth. Intuitive Surgical (ISRG, Financial) reported first-quarter earnings that surpassed expectations on both the top and bottom lines, attributed largely to COVID-19 not impacting procedure volume and addressing a backlog of procedures created by the pandemic. The company highlighted that despite COVID-19 resurgences affecting da Vinci procedure volumes in China at the start of the quarter, overall procedure volumes for 2023 benefited from addressing high patient treatment backlogs. This resulted in a revenue increase of approximately 11% from the year-ago period and a 16% growth in global da Vinci procedures. Taiwan Semiconductor Manufacturing (TSM, Financial) shares fell around 5% after CEO C. C. Wei expressed caution regarding the overall semiconductor market growth in 2024. Despite this, TSM anticipates a healthy growth year ahead. The company's first-quarter results exceeded estimates, with revenue growing 12.9% year-over-year and EPS per American Depositary Receipt outperforming expectations. This performance comes amidst a slight revenue decline compared to the fourth quarter of 2023, highlighting the company's resilience in a challenging market. Deutsche Bank downgraded Tesla (TSLA, Financial) from a Buy to a Hold rating, citing concerns over the potential delay of the Model 2 launch and a strategic shift towards the Robotaxi business. The firm emphasized the risks associated with no new vehicle in Tesla’s consumer lineup for the foreseeable future, which could impact the company's volume and pricing negatively, necessitating downward earnings estimate revisions for future years. Ocugen (OCGN, Financial) saw its shares climb approximately 7% premarket after the biotechnology firm filed a prospectus related to a securities offering. Through this shelf registration, Ocugen may offer and sell a variety of securities, aiming to raise up to $175M for general corporate purposes. This move highlights the company's strategic efforts to secure funding for its ongoing and future projects. BofA analysts updated their US 1 List, adding Cisco Systems (CSCO, Financial), Goldman Sachs Group (GS, Financial), and S&P Global (SPGI, Financial) to their collection of top investment ideas. This curated list aims to provide superior long-term investment performance, drawing from the analysts' U.S. buy-rated stocks. The update reflects BofA's latest investment insights and strategic recommendations for investors. GuruFocus Stock Analysis

Market OverviewToday's trading session on the NYSE was characterized by mostly negative performance, with the volume of trades being below average. Despite some early attempts to buy the dip, the market struggled to maintain upward momentum, closing off their lows but still reflecting an overall downside. This was largely influenced by underperformance in mega cap stocks and the semiconductor sector. Sector Performance

Notable Stock Movements

Treasury and Economic DataThe afternoon session saw some recovery attempts, partly due to favorable movements in Treasury yields. The 10-year note yield decreased by seven basis points, and the 2-year note yield fell by three basis points. This movement was supported by strong demand at today's $13 billion 20-year bond auction. Additionally, today's economic data revealed a 3.3% increase in the Weekly MBA Mortgage Applications Index and a 2.74 million barrel increase in weekly crude oil inventories. Global Markets and Commodities

Looking AheadTomorrow's economic calendar includes the Weekly Initial Claims, Continuing Claims, April Philadelphia Fed survey, March Existing Home Sales, March Leading Indicators, and Weekly natural gas inventories. These data points will provide further insights into the economic landscape and potential market movements. Guru Stock PicksRoyce International Premier Fund has made the following transactions:

Today's NewsGoogle (GOOG, Financial) (GOOGL, Financial) is reportedly making significant changes, including substantial layoffs and restructuring within its finance and real estate divisions. The company plans to establish "growth hubs" in Bangalore, Mexico City, and Dublin, signaling a shift in strategy amidst ongoing staff reductions. This move comes as Google aims to adapt to the competitive tech landscape, particularly in the AI sector, where it faces stiff competition. Kinder Morgan (KMI, Financial) disclosed its Q1 earnings, reporting a slight decline in revenue but maintaining a strong balance sheet. The company provided an optimistic outlook for 2024, projecting increases in net income, dividends, and adjusted EBITDA. These projections are buoyed by the acquisition of STX Midstream assets, indicating strategic growth despite current market challenges. Crown Castle (CCI, Financial) exceeded Q1 forecasts with its financial performance, despite a year-over-year revenue decline. The company's 2024 outlook is positive, with expectations of increased site rental billings and revenues. This optimism is reflected in Crown Castle's strategic moves, including executive leadership changes aimed at driving future growth. Home Depot (HD, Financial) experienced a continued downtrend, marking its seventh consecutive session of losses. The home improvement retailer's stock decline is notable against the backdrop of its recent performance, highlighting potential concerns within the retail sector and broader economic indicators affecting consumer spending. SL Green Realty (SLG, Financial) reported impressive Q1 results, significantly beating revenue expectations and announcing an upward revision of its 2024 FFO guidance. This positive momentum is attributed to strategic gains and reflects a recovering real estate market, especially in key urban centers. Rivian (RIVN, Financial) announced further job cuts as part of its efforts to achieve profitability amidst a challenging electric vehicle market. The company's focus on reducing costs and improving margins is critical as it navigates production and sales hurdles in a highly competitive sector. Rexford Industrial Realty (REXR, Financial) reported a solid Q1 performance, with revenue growth driven by increased net income and core FFO. The company's focus on the industrial real estate sector in Southern California positions it well for continued growth, despite minor revenue misses. Taiwan Semiconductor Manufacturing (TSM, Financial) is set to report its Q1 results, with expectations of significant earnings and revenue growth. The company's performance is particularly noteworthy given the global demand for semiconductors, underscored by recent challenges such as the earthquake in Taiwan affecting production. Las Vegas Sands (LVS, Financial) reported strong Q1 earnings, with notable revenue growth driven by its operations in Macao and Marina Bay Sands. The company's successful adaptation to post-pandemic market conditions and strategic investments in expansion projects highlight its resilience and growth potential in the gaming and hospitality industry. Discover Financial Services (DFS, Financial) reported mixed Q1 results, with earnings missing expectations but revenue showing strong growth. The company's digital banking segment faced challenges, yet showed growth in total loans, indicating a mixed financial landscape for consumer credit and banking services. CSX (CSX, Financial) reported a slight revenue decline in Q1 but saw volume growth across several segments. The company's focus on improving service performance and network reliability is key as it looks to capitalize on favorable market trends and drive future growth. Omega Healthcare Investors (OHI, Financial) faced another session of losses, extending its downward trend. The healthcare REIT's performance reflects broader challenges in the real estate and healthcare sectors, with concerns over tenant issues and dividend sustainability. Bank OZK (OZK, Financial) exceeded Q1 earnings expectations, showcasing strong revenue growth and record PPNR. The bank's positive performance and strategic focus on credit quality and growth prospects reflect a robust banking sector outlook. A Boeing (BA, Financial) engineer raised concerns over production shortcuts potentially compromising the 787 Dreamliner's safety. This revelation underscores the ongoing challenges Boeing faces in maintaining quality and safety standards amidst production pressures. Hewlett Packard Enterprise (HPE, Financial) continued its losing streak, reflecting broader market challenges and specific concerns regarding the company's growth and profitability prospects in the competitive tech sector. The political struggle over marijuana banking reform legislation highlights the complexities of navigating policy changes in a divided legislative environment, impacting companies and sectors related to cannabis banking and financing. ICZOOM Group (IZM, Financial) experienced a significant stock plunge following its decision to withdraw a registration statement for a proposed public offering, citing unfavorable market conditions. This move reflects the challenges smaller companies face in accessing public markets amidst volatile conditions. Snapchat (SNAP, Financial) saw a surge in stock price amidst news of potential fast-tracking of a bill that could impact TikTok's operations in the U.S. This development highlights the competitive dynamics within the social media and tech sectors, with potential implications for market share and user engagement. GuruFocus Stock Analysis

|

Legendary television mogul Oprah Winfrey recently announced she was stepping down from the board of directors of WeightWatchers.

The announcement, along with fourth-quarter financial results, sent shares of WeightWatchers parent WW International WW lower last month.

Part of the reason for Winfrey's exit may now be known.

What Happened: Weight loss drugs have been one of the biggest topics globally over the past year, leading to increased share prices for several pharmaceutical companies cashing in on the craze.

Winfrey hopes to shed more light on weight loss drugs and their potential positives and negatives based on her own personal experiences and medical experts.

A television special titled "An Oprah Special: Shame, Blame and the Weight Loss Revolution" was recorded by the television host in front of a live studio audience and includes interviews from medical experts, Variety reports.

The hour-long special will air on ABC, a unit of Walt Disney Co DIS on March 18 at 8 p.m. ET. The special will also be available on streaming platform Hulu the following day.

"It is a very personal topic for me and for the hundreds of millions of people impacted around the globe who have for years struggled with weight and obesity," Winfrey said in a statement. "This special will bring together medical experts, leaders in the space and people in the day-to-day struggle to talk about health equity and obesity with the intention to ultimately release the shame, judgment and stigma surrounding weight."

According to the report from Variety, topics addressed in the special include who weight loss drugs are intended, who can receive weight loss drugs and what are the short-term and long-term side effects from weight loss drugs.

"We are thrilled to work with Oprah and the voices she has assembled to open a dialogue that destigmatizes and educates viewers on the important and polarizing topic of weight loss," Disney Television Group President Craig Erwich said.

Related Link: Weight Loss Drugs Wegovy, Ozempic Gain Traction With Millennials, High Earners: New Survey Results

Why It's Important: Weight loss drug stocks could be in the spotlight for the television special.

Novo Nordisk A/S NVO is the company behind Ozempic and Wegovy. Shares of the company are up 85% in the last year and over 400% in the past five years. The company is now valued at around $595 billion, ranking 12th among public companies globally.

Eli Lilly And Co LLY is behind Mounjaro. Shares of the company are up 145% in the last year and over 500% in the past five years. The company is now valued at $724 billion, ranking 10th among public companies globally.

Given the topics mentioned above, there is the possibility that weight loss drugs get a positive spotlight, but also caution on who should be taking them and the potential side effects that could scare people away.

Winfrey is widely regarded as one of the top talk show hosts of all time and her specials often generate millions of viewers, setting up a potential win for Disney and putting a watch on weight loss drug stocks.

The special comes after Winfrey stepped down from the WeightWatchers board after around 10 years and after acquiring 10% in the company.

Winfrey admitted to People magazine in December that she had taken weight loss drugs, but did not name which medication she took.

"The fact that there's a medically approved prescription for managing weight and staying healthier, in my lifetime, feels like relief, like redemption, like a gift, and not something to hide behind and once again be ridiculed for," Winfrey told People.

Read Next: Cannabis With Ozempic, Wegovy, Other Weight-Loss Drugs: Here’s What You Need To Know If You’re Combining Them

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

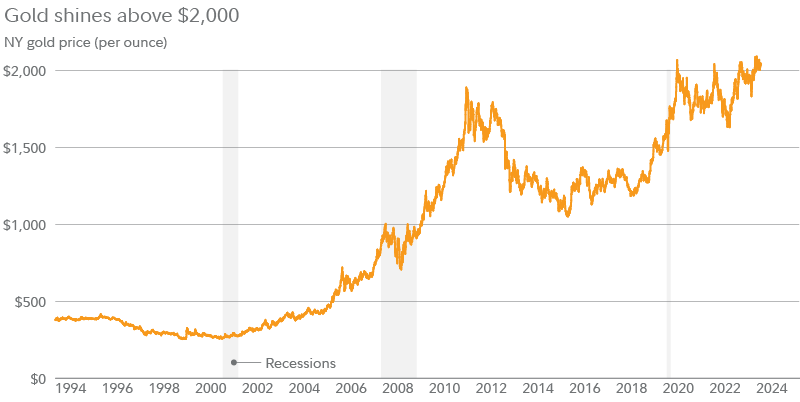

There are a variety of reasons why an investor might want to buy gold: Speculating it will increase in value, to hedge against inflation, and as source of diversification with other assets, to name a few. And with prices near all-time highs (see Gold shines above $2,000 chart), it’s easy to see why many investors are interested in gold.

If you are considering buying gold, here are the ways that you can do it.

Essentially, there are 2 main ways to buy gold: physical gold and gold-related financial investments. While these methods have different characteristics and expertise needed, among other factors, the end goal of getting exposure to gold is the same.

Physical gold. You can touch and look at a physical piece of gold. Bars and coins (i.e., bullion) as well as jewelry are physical gold assets. It’s worth noting that physical gold is marked up from the spot price of gold, and jewelry even more so. Physical gold can be bought from individuals, jewelers, gold dealers, and some banks.

There is no requirement to own an investing account to buy physical gold and the main factor that influences how much it is worth is the underlying price of gold (as well as how rare it is—a stronger factor for gold jewelry). However, owning real gold can require storing and safeguarding it.

Financial investments. These include gold funds (e.g., ETFs and mutual funds), gold futures, and gold stocks. While the various forms of physical gold are mostly similar (consider a gold bar and a gold coin that differ mostly in size), financial gold investments can vary substantially. Investing in gold this way necessitates an investment account (such as an individual brokerage account or IRA). Buying gold-related investments typically involves more complexity compared with owning physical gold, as there can be multiple factors that influence each investment. Let’s break each one down so you can get a sense of the different aspects.

-----------------------------------------------------------------------------------------------------------------------------

US stocks surged in 2023, but those gains were concentrated in big tech stocks for the most part. This is unusual because sustained market rallies have historically occurred across sectors, not concentrated in a handful of stocks. The good news is there’s growing evidence recently that the rally is starting to broaden. Two sectors joined tech in hitting new all-time highs (health care and industrials) and two others closed within 5% of their all-time highs (financials and materials). Moreover, data from CFRA, an independent investment research firm, reveals that 28 out of the 126 S&P 500 sub-industries hit new all-time highs.

IBKR feb 29 2024

Services Prices Post a Fierce Acceleration: Feb. 29, 2024 | Traders' Insight (ibkrcampus.com)

Newsletter Feb 2024 Fidelity Investments, Inc.

7 things you may not know about IRAs | Fidelity